Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Nato is to agree an overhaul of its plans to offer better protection to the alliance’s eastern flank, tearing up a model that could have meant relinquishing Baltic states and then attempting to recapture them in the event of a Russian invasion.

Jens Stoltenberg, Nato secretary-general, told the Financial Times that the military blueprint, to be agreed at an annual leaders’ summit that begins in Madrid tomorrow, would drastically upgrade the alliance’s eastern defences, shifting focus from deterrence to a full defence of allied territory.

Estonia’s prime minister has claimed that under the current doctrine, Baltic states would be “wiped off the map” by a Russian assault before Nato attempted a counter-attack to liberate them after 180 days.

The alliance will “significantly reinforce” its defences in eastern Europe, Stoltenberg said, pledging that Russia would not be able to capture the Estonian capital Tallinn “just as they have not been able to seize the city of Kirkenes in northern Norway or West Berlin during the cold war”.

More on Russia’s war in Ukraine

-

Military developments: Russian missiles struck residential buildings in central Kyiv yesterday. Ukraine’s retreat from the eastern city of Severodonetsk was a “tactical” move to avoid a repeat of the siege in Mariupol, the country’s military intelligence chief said.

-

Energy politics: G7 leaders meeting in the Bavarian Alps are seeking a deal to impose a “price cap” on Russian oil to curb Moscow’s ability to finance its war.

Thanks for reading FirstFT Europe/Africa. To start your week, here’s the rest of the day’s news. — Jennifer

Five more stories in the news

1. EY valued NSO Group at $2.3bn The Big Four accounting firm valued the secretive Israeli spyware company at $2.3bn, months before the maker of the Pegasus cyberweapon needed emergency bailout funding. By contrast, Berkeley Research Group, which represents NSO’s private equity owners, said this year that the company’s equity was “valueless”.

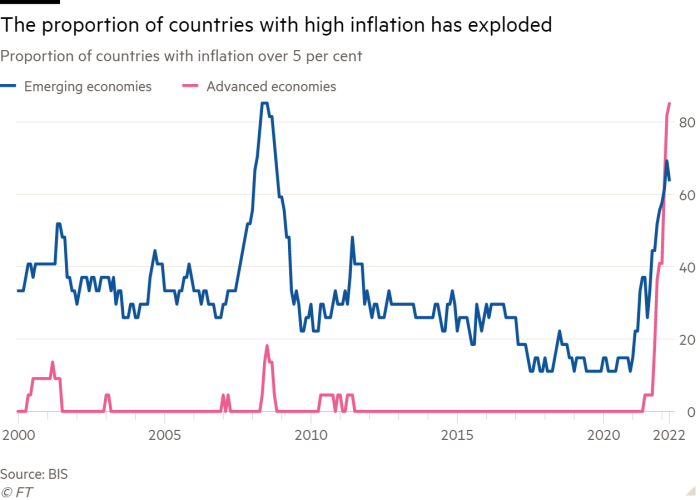

2. BIS: leading economies at risk of high-inflation trap The Bank for International Settlements warned yesterday that major economies were close to “tipping” into a high-inflation world in which rapid price rises dominate daily life and are difficult to quell, and urged central banks not to be shy about inflicting short-term pain and even recessions to prevent it.

3. RWE: UK windfall tax could risk £15bn in renewables The head of one of the country’s largest power producers has warned that Germany’s biggest utility will reconsider £15bn of investment in the UK’s renewable energy sector if the country imposes a windfall tax on electricity generators.

4. UBS courts US investment heavyweights The Swiss lender, the world’s biggest wealth manager, has begun courting investment houses to become top shareholders as it tries to improve its market value to be closer aligned with Wall Street peers and project an image as a global bank.

5. UK Treasury takes stake in sex party planner The British taxpayer has become a shareholder in Killing Kittens, known for its exclusive and hedonistic events, under the Future Fund, a scheme set up by Chancellor Rishi Sunak to support innovative firms during the pandemic under which loans are converted into equity.

The day ahead

UK lawyers on strike Members of the Criminal Bar Association begin a walkout in an escalating dispute with the government over funding, which is expected to cause widespread disruption to hearings across England and Wales.

UK changes N Ireland trading regime MPs will have their first vote on Boris Johnson’s legislation to unilaterally rip up parts of Northern Ireland’s post-Brexit trading arrangements, despite fierce criticism from Brussels.

Economic indicators The annual European Central Bank Forum on Central Banking begins in Sintra, Portugal. In the US, durable goods orders may show whether inflation, rising interest rates and economic uncertainty weighed on demand in May. (FT, WSJ)

UN Ocean Conference The week-long conference on ocean conservation and sustainability starts and is co-hosted by Kenya and Portugal.

Companies developments Nike posts fourth-quarter results. Disney’s board meets for two days less than a week after giving under-fire chief executive Bob Chapek a vote of confidence.

Wimbledon begins The tennis tournament starts at the All England Lawn Tennis and Croquet Club in south-west London without the men’s top player or women’s reigning champion. Daniil Medvedev is ineligible after a ban on Russian players, while Ash Barty has retired. “Retiring aged 25 seems like filing for divorce while on honeymoon. But Barty’s decision reveals various truths,” writes Henry Mance.

What else we’re reading

Grim times lie ahead for UK The country is in the throes of the kind of labour unrest not seen for decades. The explanation for it is clear. Unanticipated inflation delivers losses everybody wants to recoup. This triggers social conflict, writes Martin Wolf. Yet if inflation is bad, so is the cure.

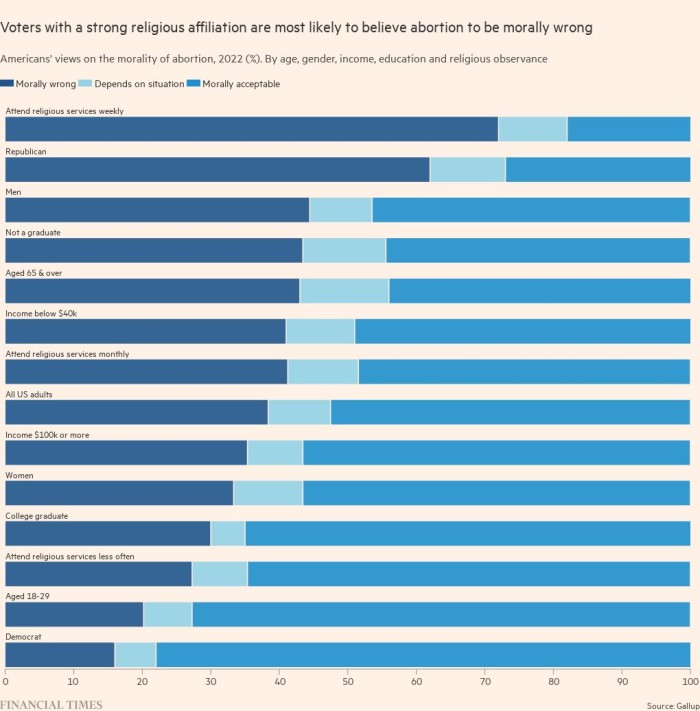

The road to rolling back Roe vs Wade As the Supreme Court overturns the landmark 1973 ruling enshrining the constitutional right to abortion, Lyz Lenz documents the rise of the Christian right and how it reached this historic moment. In response to the ruling, Democratic lawmakers are stepping up efforts to establish “sanctuary states” for reproductive rights.

Crypto and meme corporate bonds follow their own path The crash of some of the flagbearers of the equity bubble has been painful for investors. Less noticed are the losses of their bonds. Such gaps illuminate differences in the ownership and returns for stocks versus bonds, writes Ellen Carr at Barksdale Investment Management.

How the beauty industry left tortoise-like Revlon trailing Once a behemoth of the beauty industry, Revlon has been sidelined by modern influencer- and social media-driven make-up brands. The 90-year-old group’s bankruptcy filing reveals how competitive and fast-paced the sector has become.

There’s no such thing as an accidental plagiarist The acclaimed Australian novelist John Hughes claims that many of the 58 instances of plagiarism in his new book were by accident. Everyone steals when they write, but where does “good” theft end and clumsy rip-off start?

Books

Whether you are looking for a book on urbanism, a literary thriller, a tome on the royal family or something else unexpected, you will want to take a look at these must-read titles recommended by FT writers and editors.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.